Monthly Investment P/L: +HK$-34,000

started out as a great month, but dropped down toward the end of the month (no santa rally).

It’s a good thing though because I just received the $1.3M cash from grandma’s home sale and I need to start buying, so buying after a dip is better.

Current Portfolio:

HKD/USD cash: 42.37% (8.85%)

USD ST bonds: 0% (0%)

USD stocks: 13.09% (18.91%)

JPY stocks: 8.14% (13.67%)

Bitcoin (USD): 7.98% (12.33%)

Gold (USD): 28.39% (45.16%)

YEN cash: 9.07% (15.83%)

YEN shorts: -9.03% (-14.74%)

—

So there wasn’t actually much change at all, a little drop in gold weight and a little more with USD stocks and bitcoin that was all.

But with the fresh capital now the cash is really heavy. I’ll deploy it as it goes up or down … if it goes flat I’ll hold onto the cash a little longer then.

US Equity

Still strong despite some corrections after the Fed’s hawkish cut in December.

Nevertheless that’s also could be good since it’s getting pretty hawkish during this rate-cut cycle now so any “good news” regarding lower inflation data would probably drive up the market.

On the other hand if inflation gets really stubborn and the Fed ends this cutting cycle early and start raising, then it probably can get a bit ugly. I am not seeing this as the base case scenario though, since Trump probably won’t want the market to fall and they will probably fabricate something up to keep the cutting cycle going.

If they get more dovish moving forward, then it’s going to be a full bull market – equity, gold, bitcoin, everything will jump as the USD gets weaker.

So the biggest risk in my entire portfolio is strong dollar, and I guess that can’t be helped since I am on the side of “betting against the dollar”. with the mounting debt and de-globalization, dollar could probably only get weaker from here and positioning against it should be the best move long-term and that’s my biggest bet over the next 10-20 years.

In the short term though I guess I’ll have to put up with some volatility possibly coming up if the USD continues to get stronger…

JP Equity

same old pretty much, also staying put here.

With the new year I’ll get my new NISA quota and I’ll put them all into 1489.

After some research it seems 1489 has a higher return with a less volatility than N225 over the past number of years, so it’d only make sense to allocate some over there.

In the long run I guess I’ll go 50-50 on those two.

Previously I was thinking to allocate some semiconductors like 221A but now it just looks too volatile for the return and the sharpe ratio is therefore pretty low. I might re-assess later on but for now I’ll just wait for the entire Japanese equity market for the next breakout to nikkei225 – 50k.

Gold

Laid completely flat for the month.

Which is not bad and considering I’ll be adding much more with the fresh capital, let’s hope it’ll keep down or even drop a bit more before surging back up.

In any case I’ll still DCA into it just to make myself a bit more comfortable.

Crypto

So I ended up deciding to raise it to 15%.

It’s riskier but I also have a long time horizon, and I think it’s very unlikely to get bitcoin extinction at this point.

BTC has been laying flat for the month, while MSTR is getting a bit hammered.

I see this as a buying opportunity for MSTR though and the next leg for BTC to hit 120-150k, MSTR will go at least 2-3x and I’ll be positioned to make a large gain there.

Thoughts – add more leverage?

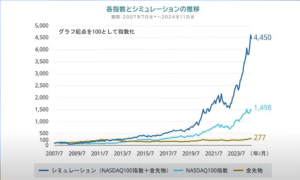

So I was watching a youtube video talking about a fund that invest 100% nasdaq500 + 100% gold futures, a total of 200% leveraged investment.

And in the past year that fund yield 70%+ return as opposed to 30% for gold and 28% for S&P.

Looking at the past 20 years the biggest drawdown for this leveraged play is actually less than S&P500 itself. The volatility is a bit higher but the return/risk score is higher than nasdaq100 itself.

So first of all that reaffirms that my ~40-50% gold 50% risk-asset play is pretty good – a very good return to volatility score.

And with a longer horizon, I really should consider adding more leverage to this play since I can afford to take some temporary drawdown.

However it can’t be 100% leverage since I’ll need the extra leverage in case I need emergency cash or want to use it to buy a home, either in Hong Kong or Japan.

Considering that I am currently at 0% leverage (only shorting the yen cash), and I am thinking maybe adding 10-20% leverage would be reasonable.

Maybe let’s start with 5% after all the cash is deployed and see if I want to increase it from there.

(just a simple calculation – a +5% leverage position would mean extra $170k invested – at 10% annual return that’s $17k per year or $1.5k per month).